An Unbiased View of Feie Calculator

Table of ContentsSome Known Details About Feie Calculator The Facts About Feie Calculator RevealedHow Feie Calculator can Save You Time, Stress, and Money.The Greatest Guide To Feie CalculatorGetting My Feie Calculator To WorkHow Feie Calculator can Save You Time, Stress, and Money.Indicators on Feie Calculator You Need To Know

As a whole, U.S. citizens or irreversible lawful homeowners living abroad are qualified to assert the exemption. The quantity of the exclusion is readjusted each year based upon the price of rising cost of living. The amount of exemption for current and past tax years is as follows:2015: $100,8002014: $99,2002013: $97,6002012: $95,100 In enhancement to this earnings exclusion, the taxpayer may additionally qualify to leave out the value of employer-provided dishes, lodging and specific additional benefit.To start with, federal government staff members are generally ineligible for the foreign revenue exemption even if they are living and functioning in a foreign nation. A two year-old D (https://www.empregosaude.pt/author/feiecalcu/).C. Circuit Court choice, Rogers v. Commissioner, might place the value of the foreign earnings exemption in jeopardy for thousands of migrants. Rogers involved a U.S

Unknown Facts About Feie Calculator

The exact same policy would use to somebody who services a ship in global waters.

The Foreign Earned Earnings Exclusion (FEIE) enables qualifying U.S. taxpayers to omit as much as $130,000 of foreign-earned income from united state government earnings tax obligation (2025 ). For several migrants and remote employees, FEIEs can indicate considerable savings on U.S. taxes as foreign-earned revenue could be subject to double taxes. FEIE jobs by excluding foreign-earned income as much as a details limitation.

In contrast, easy revenue such as interest, dividends, and capital gains don't receive exclusion under the FEIE. Particular qualification examinations need to be fulfilled in order for expatriates to receive the FEIE stipulation. There are two key examinations to figure out eligibility for the FEIE: the Physical Presence Examination and the Bona Fide House Examination.

Feie Calculator Fundamentals Explained

The United state taxpayer must have foreign-earned earnings. This U.S. taxpayer should have a tax obligation home in an international nation (with a tax obligation home specified as the area where an individual is engaged in work).

It's advised that individuals use travel trackers or apps that allow them to log their days spent in various places, guaranteeing that they meet the 330-day need. The United state taxpayer need to have a tax home in an international nation.

taxpayer must have been a bona fide citizen of a foreign nation for a minimum of one tax year. "Authentic local" standing calls for demonstrating long-term foreign living with no impending go back to the U.S. Key signs of this status might include lasting housing (whether leased or possessed), regional bank accounts, or acquiring a residency visa.

The Of Feie Calculator

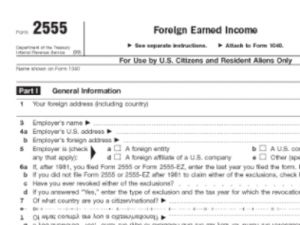

For married pairs, both partners will require to fill up in a separate Type 2555, even if they're filing tax obligations jointly. To complete a 2555 form, you'll require to: Select in between the Authentic Home Test and the Physical Visibility Test Document all global traveling to and from the US throughout the tax obligation year.

Mark determines the exchange price (e.g., 1 EUR = 1.10 USD) and transforms his income (54,000 1.10 = $59,400). Since he lived in Germany all year, the percent of time he resided abroad during the tax is 100% and he enters $59,400 as his FEIE. Lastly, Mark reports overall salaries on his Type 1040 and enters the FEIE as an adverse amount on time 1, Line 8d, decreasing his taxed earnings.

Feie Calculator for Dummies

Picking the FEIE when it's not the very best choice: The FEIE might not be perfect if you have a high unearned income, gain even more than the exemption limit, or live in a high-tax country where the Foreign Tax Obligation Credit Rating (FTC) might be much more helpful (Bona Fide Residency Test for FEIE). The Foreign Tax Obligation Credit Score (FTC) is a tax decrease technique usually utilized along with the FEIE

expats to counter their united state tax debt with international income taxes paid on a dollar-for-dollar decrease basis. This suggests that in high-tax nations, the FTC can often get rid of U.S. tax obligation financial obligation totally. The FTC has constraints on qualified taxes and the maximum insurance claim quantity: Qualified taxes: Only income tax obligations (or taxes in lieu of income taxes) paid to international federal governments are qualified.

tax obligation obligation on your foreign earnings. If the foreign taxes you paid exceed this limitation, the excess foreign tax can typically be continued for as much as 10 years or returned one year (through a modified return). Preserving accurate records of international revenue and tax obligations paid is therefore essential to computing the proper FTC and keeping tax obligation conformity.

Feie Calculator Things To Know Before You Buy

expatriates to reduce their tax liabilities. If an U.S. taxpayer has $250,000 in foreign-earned earnings, they can leave out up to $130,000 utilizing the FEIE (2025 ). The remaining $120,000 might then undergo taxes, however the united state taxpayer can possibly apply the Foreign Tax obligation Credit rating to offset the tax obligations paid to the foreign nation.

If he 'd regularly taken a trip, he would instead complete Part III, detailing the 12-month period he met the Physical Existence Examination and his traveling history. Step 3: Reporting Foreign Revenue (Part IV): Mark gained 4,500 per month (54,000 every year).

The Only Guide to Feie Calculator

Selecting the FEIE when it's not the very best choice: The FEIE may not be excellent if you have a high unearned earnings, make greater than the exemption limitation, or reside in a high-tax country where the Foreign Tax Obligation Credit Scores (FTC) might be a lot more advantageous. The Foreign Tax Obligation Credit Rating (FTC) is a tax obligation decrease technique frequently used together with the FEIE.

expats to counter their united state tax financial obligation with foreign income taxes paid on a dollar-for-dollar decrease basis. This suggests that in high-tax nations, the FTC can often eliminate united state tax obligation financial obligation completely. The FTC has constraints on qualified tax obligations and the optimum insurance claim amount: Qualified tax obligations: Only income taxes (or taxes in lieu of income taxes) paid to international federal governments are eligible.

tax obligation obligation on your foreign income - https://www.find-us-here.com/businesses/FEIE-Calculator-Atlanta-Georgia-USA/34329836/. If the foreign tax obligations you paid surpass this limitation, the excess international tax can typically be continued for as much as 10 years or lugged back one year (by means of a modified return). Preserving precise records of international earnings and tax obligations paid is as recommended you read a result vital to computing the right FTC and keeping tax compliance

expatriates to decrease their tax obligation liabilities. For example, if an U.S. taxpayer has $250,000 in foreign-earned earnings, they can exclude approximately $130,000 utilizing the FEIE (2025 ). The remaining $120,000 may then go through tax, but the united state taxpayer can possibly apply the Foreign Tax Credit to balance out the tax obligations paid to the international nation.